Startups talk a lot about tech debt. We almost never talk about discovery debt.

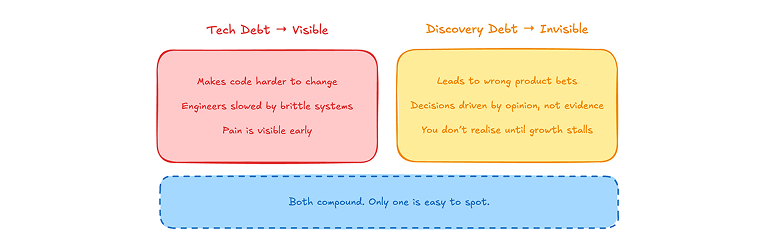

Tech debt is visible. You see it when changes take longer than they should, engineers get slowed down, and the pain is obvious early.

Discovery debt is quieter. It builds when you skip the hard work of learning. Decisions get driven by opinion, not evidence. Wrong bets pile up. You don't notice until growth stalls.

I've lived both sides. In the scrappy early days, discovery wasn't optional - no customers, no product. Later, as things scaled, it was easier to believe we already "knew enough". That's exactly when discovery debt sneaks in.

The thing is, discovery often feels like it slows you down. When the pressure's on, talking to customers or testing assumptions looks like time you don't have. But in reality, a small dose of discovery keeps you moving faster in the long run - because you're making more confident decisions about what value to unlock and why.

Tech debt slows teams down. Discovery debt blinds them. Both compound - but only one is easy to spot. The cure is to keep learning, even when it feels slower in the moment.